Ahead of the Curve: The Capital Market Recap

AWiBers and guests streamed into AWiB Connects @ the Hilton at 5:30 PM on June 5, 2025, for their monthly networking and panel discussion. The crowd was buzzing with the familiar warmth of being able to connect and discuss the networking questions based on the key topic of the evening ‘Ahead of the Curve: The Capital Market’.

Betelhem Birhanu, Secretary of AWiB 2025 Board welcomed the audience and invited members to promote their services and products as part of their monthly benefit. Those presented were the Association of Chartered Certified Accountants (ACCA), Nyala Insurance, Tsehay Bank, Mehon Crafts, Yeti Pads as well as representatives from the ESX and Meri program. Betelhem then introduced the moderator of the evening, Tizita Shewaferaw, a storyteller, editor, and communication specialist.

Tizita introduced the much anticipated speakers: Hana Tehelku, Director General of the Ethiopian Capital Market Authority (ECMA), a distinguished legal professional known for her tenacity and integrity and Dr. Tilahun Esmael Kassahun, the Founding CEO of the Ethiopian Securities Exchange (ESX).

Hana’s presentation provided a comprehensive overview of Ethiopia’s evolving capital market landscape and the importance of women’s inclusion within it.

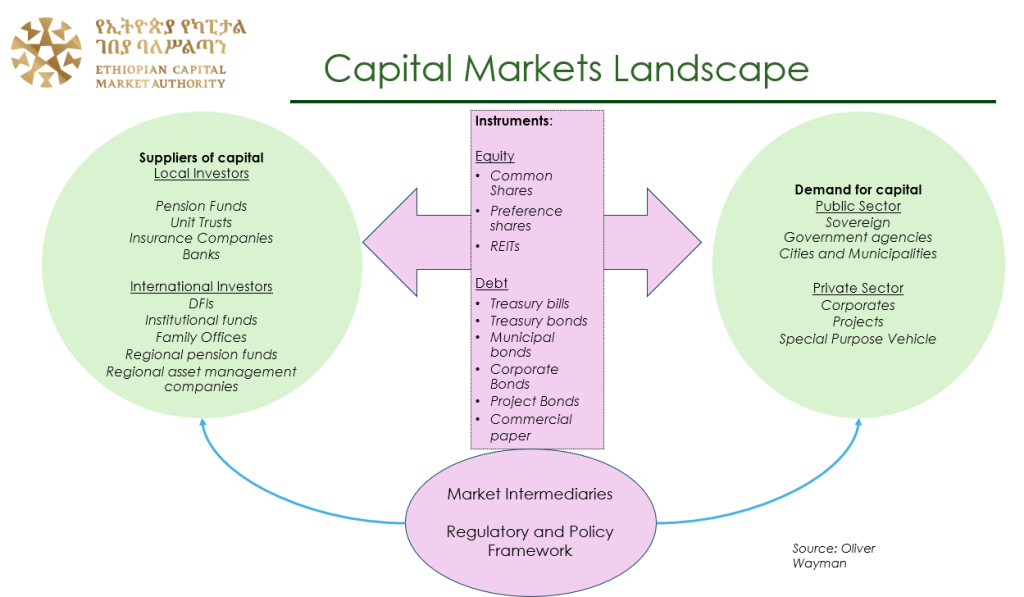

The capital market ecosystem is vital in connecting suppliers of capital such as pension funds, insurance companies, banks, DFIs, and international investors with the demand for capital. The capital could be sourced from public and private sectors, especially for small and medium enterprises (SMEs) through a variety of financing sources including equity, debt, and project bonds.

Hana explained how the capital market would fill the gap between the demand for innovative and long term sources of funding and what banks and standard financial institutions can offer. The capital market provides the opportunity for increasing the diversity of financing sources for corporations and individuals.

She highlighted a key milestone, the passing of Proclamation No. 1248/2021, that officially established ECMA as an autonomous regulatory body. The objectives of ECMA include ensuring investor protection, maintaining fair and efficient markets, encouraging innovation, and expanding access to finance, especially for underrepresented groups.

A core part of Hana’s presentation centered on empowering women through capital markets that gives them access to knowledge, resources, and opportunities. This involves financial literacy and education, promoting gender-focused investment products such as gender bonds, and encouraging women-led businesses to tap into capital markets.

Hana explained how the public can participate in the capital market. Investors can engage via brokerage firms and investment advisors. Issuers work with Capital Market Service Providers (CMSPs). Service Providers must be licensed by ECMA and can access sandbox environments for fintech testing.

The second speaker Dr. Tilahun presented the vision of the capital market ecosystem as a disclosure-based infrastructure built on trust, transparency, intermediaries, and liquidity. The Ethiopian Securities Exchange (ESX) is a multifaceted market platform enabling both large and small enterprises to raise capital and thrive. It enables those who have good ideas but do not have collateral to gain access to financing.

ESX and Central Securities Depository (CSD) are core infrastructures in the capital market. Key components of the ecosystem include: retail & institutional investors, government entities, investment banks, brokers and rating agencies.

The ESX is structured into three major segments: the main market, growth market and the alternative market. The main market holds established companies with large capital. The growth market tailors to smaller, growing enterprises. The alternative market covers crowdfunding, OTC trades, digital/blockchain-based markets, carbon markets, and private placements.

ESX also offers diverse financial products, including equity instruments (common shares, ETFs, REITs), fixed-income products (corporate/municipal bonds, sukuks), thematic and structured bonds, and money market tools (T-bills, repos).

Dr. Tilahun emphasized the ESX’s pivotal role in financing the Ethiopian economy; it promotes innovation and improves capital access for all segments including women-led enterprises and startups.

During the Q & A, the audience raised a range of insightful questions – the liquidity of shares, brokers fees, licensing institutions, and how the capital market accommodates Islamic financing principles. Additional questions included awareness creation, the effect of inflation, measures taken in combatting corruption, cybersecurity, and market monopolization.

Hana explained that capital markets offer faster transactions taking approximately 90 days to complete a deal. This leads to greater liquidity compared to the current share market. She noted that the ECMA is responsible for licensing share sellers and ensuring inclusive access including accommodations for faith-based financial principles.

Addressing concerns on corruption, Hana acknowledged its widespread presence while emphasizing that the ECMA has a market surveillance system to combat corruption. This system allows experts to detect and address market manipulations swiftly and effectively.

Dr. Tilahun added that the capital market presents an innovative way to support promising ideas and entrepreneurs in the community by enabling people to invest through small share purchases. However, he reminded participants that not all investments will succeed and that investors should be mindful of the associated risks. He stressed the importance of understanding the time value of money, a concept not currently implemented in Ethiopia’s informal share market.

He asserted that market monopolization existing in the broader economy could also be reflected in capital markets. While it’s possible that some companies could dominate, investors have a wider range of options in the capital market.

Tizita concluded by thanking both the speakers and the audience for their active participation and extended gratitude to Kabba Transportation for organizing safe transport for attendees who requested the service. In keeping with AWiB tradition, Bethlehem presented gifts to the speakers and moderator. Attendees left with a deeper understanding of Ethiopia’s emerging capital markets, some stayed behind to ask follow-up questions.

Share to your circles!